Difference types

Difference types are used for identifying and explaining the differences in intercompany transactions. For example, an invoice booked on the Accounts Receivable (AR) at one subsidiary but not booked on the Accounts Payable (AP) of the payer, on time, correctly, or at all, gives rise to huge differences which cause problems on the consolidated accounts. In intercompany Management, we need to identify and explain these differences with Difference types so that the necessary adjustments /corrections can be done at the consolidation level before the financial close

Sources of differences that may occur during the intercompany reconciliation process include the following:

| Difference type | Description |

|---|---|

| Timing difference | This occurs when a buyer does not receive an invoice within the time period that the purchase was made from the buyer. |

| Currency conversion | Occurs when the two parties record the invoice in their local books using different exchange rates. |

| Capitalization | An accounting method in which a cost is included in the value of an asset and expensed over the useful life of that asset, rather than in the period the cost was originally incurred. |

| VAT | Occurs where mixed and partial taxable persons do not have a full right of deduction but can only deduct VAT (Value Added Tax) on their purchases to the extent that those purchases are used for output on which VAT is payable. |

| Disputes | Buyer disagrees with the invoice or part of it. Dispute reasons include price dispute, quality of goods, product never receive, double billing, administrative error, etc. |

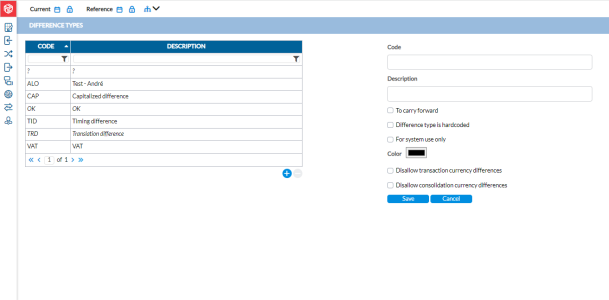

To access the Difference Types page, click ![]() Period Management > Difference Type

Period Management > Difference Type

The left-side panel displays the list of the existing difference types. The right side is where you define a new one.

Add a difference type

-

Click

.

. -

Enter the Code and Description of the difference type in their respective fields.

-

Select one of the options for the marking:

- To carry forward - allows any transaction marked with this difference type to be copied to a new period.

-

For system use only - restricts the use to the system only (not to be used for manual marking).

-

Disallow transaction currency differences - cannot be used for any difference resulting from transaction currency differences.

-

Disallow consolidation currency differences - cannot be used for difference types that are a result of combining the financial statements of two companies when they operate in different currencies

-

In the Color field, select a color to identify the difference type.

-

Optionally, to exclude transactions with transaction currency differences, select Disallow transaction currency differences (transactions with thresholds cannot be marked with this difference type.)

-

Optionally, to exclude transactions with consolidation currency differences, click Disallow consolidation currency differences

-

Click

.

.