Intercompany rules

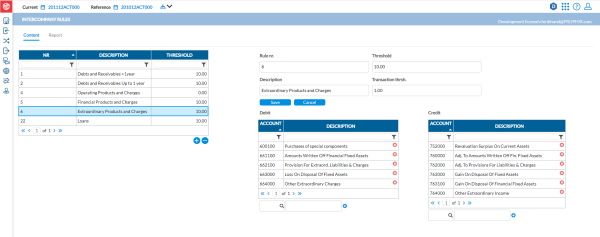

The Intercompany Rules page allows you to define the reconciliation rules at transaction and threshold levels for intercompany transactions.

Note: Intercompany rules can be uploaded from Financial Consolidations using Import Interco Rules functionality.

To access the Intercompany Rules page, click ![]() System Structures > Intercompany Rules.

System Structures > Intercompany Rules.

When you select an intercompany rule, you will see on the right-side panel, the description, the threshold and, the debit and the credit accounts belonging to the selected rule.

On the left-side panel is a list of all existing intercompany rules along with their codes and descriptions.

The right-side panel is where you can define a new intercompany rule. You can also view and modify the detail parameters of the existing intercompany rules.

-

Rule nr- code of the intercompany rule.

-

Description- description of the intercompany rule.

The Debit and Credits sections is where you set up the content of the rule:

-

Debit- list of debit type intercompany accounts for the selected rule (Assets or Charges);

-

Credit- list of credit type intercompany accounts for the selected rule (Liabilities or Incomes).

Threshold

Thresholds determine the transactions that will be marked automatically by Intercompany Management. Any difference in transaction amounts at or below the specified threshold will be marked automatically. If the difference in the amounts recorded for the transaction by the intercompany partners is greater than the threshold, that transaction has to be marked manually.

In the application, you can enter two types of thresholds:

-

For the intercompany rule

-

For each transaction (grouping transaction by invoice number)

Note: The threshold of the intercompany rule is dominant.

| Cy A -> Cy B | invoice 1 | 1000 | |

| Cy A -> Cy B | invoice 2 | 1500 | |

| Cy B -> Cy A | invoice 1 | 1005 | |

| Cy B -> Cy A | invoice 2 | 1600 |

The difference for the Interco rule is 105

The difference for transaction 1 = 5

The difference for transaction 2 = 100

1st case

Threshold for Interco rule = 0

Threshold by transaction = 0

In this case no automatic marking will be done for the transactions; the difference will have to be marked manually.

2nd case

Threshold for Interco rule = 10

Threshold by transaction = 5

The difference for the Interco rule (105) is bigger than the Interco rule threshold (10). So no automatic marking will be done at Interco rule level.

BUT transaction 1 will be marked automatically as the difference for this transaction (5) is not bigger than the transaction threshold (5).

Transaction 2 will have to be marked manually as in this case the transaction difference (100) is bigger than the transaction threshold (5)

3rd case

Threshold for Interco rule = 200

Threshold by transaction = 0

In this case, all transactions will be marked OK automatically as the rule difference is smaller than the thresholdand the rule threshold takes precedent over the transaction threshold

Create a new intercompany rule

-

Click

.

. -

Enter the Rule nr, Description, and Thresholds for the rule.

-

Click

.

. -

Next, you will search for the intercompany accounts to be reconciled on the Debit and Credit sides.

-

Debit table - debit type intercompany accounts for the rule (Assets or Charges).

-

Credit table - credit type intercompany accounts for the rule (Liabilities or Incomes).

-

-

In the search field of the Debit table, enter or search for the debit account you want to add, and then, click

to add it.

to add it. -

In the search field of the Credit table, enter or search for the credit account you want to add, and then, click

to add it.

to add it.

Generate intercompany rules report

-

Click the Report tab.

-

Select the rules you want to include in the report.

-

In the Export format field, choose the output file type you want. Options include PDF, XLS, XLSX, and CSV.

-

Click

to generate the report. After the report is generated, a download link appears below for you to click and view the report in the file format you selected.

to generate the report. After the report is generated, a download link appears below for you to click and view the report in the file format you selected.